The COVID-19 pandemic has caused an economic crisis that is unprecedented in scale and nature. NAPCO Research has initiated a new research program to gauge the effects of the pandemic on the promotional products industry (NAPCO is the parent company of Promo Marketing). The first report in this program looked at data from promotional products businesses that were surveyed in mid-May, and the second report contains data from businesses surveyed in early July. A comparison of the data between the two reports reveals that while sales are still trending down for a majority of promotional products businesses, fewer are reporting a downward sales trend in the second report compared to the first report (57.3 percent, down from 74.3 percent).

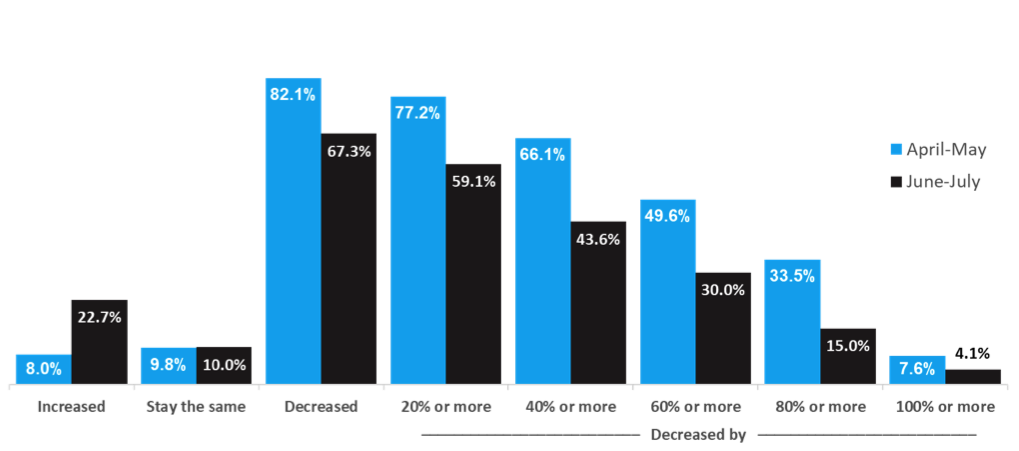

Sales fell on average 16 percent, weighted by company revenue, for all companies surveyed between early June and early July, down from a 24.7 percent fall between mid-April and mid-May (Figure 1). The research also indicates that while the promotional products industry continues to contract, more companies now report that activity is picking up compared to the first survey period. Many businesses have taken action to protect themselves from the effects of the economic crisis, including taking advantage of government loans and pivoting to selling PPE products.

Figure 1: Sales Change Last 30 Days

n=220

To help promotional products companies navigate the crisis to the recovery on the other side, NAPCO Research has launched the COVID-19 Promotional Products Business Indicators Research. This research initiative takes the pulse of the industry by surveying a cross-section of promotional products companies, including promotional products distributors, suppliers/manufacturers and apparel decorators. Click here to download the second full report.

Index Signals Future Improvement Likely

The research tracks current and leading business indicators. The index of current business indicators (including sales, employment, prices and pre-tax profitability) for the promotional products industry closed at 38.6 for the current period, compared to 33.1 for the first report. A reading below 50.0 means more companies report activity is falling than report activity is rising.

The index of leading business indicators (quote activity, new orders and confidence) closed at 46.6 for the current period, compared to 35.2 for the first report. A reading below 50.0 means more companies report these forward-looking measures of activity are falling than report they are rising. Both indices have risen since the first report, which indicates that while the promotional products industry is still contracting, more companies report that activity is picking up compared to the previous survey period. The index of leading business indicators value of 46.6 suggests that businesses will continue to improve compared to current conditions.

Companies are taking action to stay afloat. Many of the companies surveyed have adjusted course aggressively to weather the economic crisis. With most product categories seeing continued sales declines, many businesses have shifted their focus to the sole product category that is experiencing growth: healthcare. Those businesses that are flexible enough to make this transition have been able to offset some of their losses in other areas. One respondent writes, “PPE orders are all that is HOT right now.”

Many businesses have also taken advantage of government loans. 49.5 percent of respondents have been approved for one or more such loans. The most common loan applied for is the Paycheck Protection Program (PPP), which makes up 57.8 percent of all loans applied for, followed by the SBA Economic Injury Disaster Loan (22.9 percent).

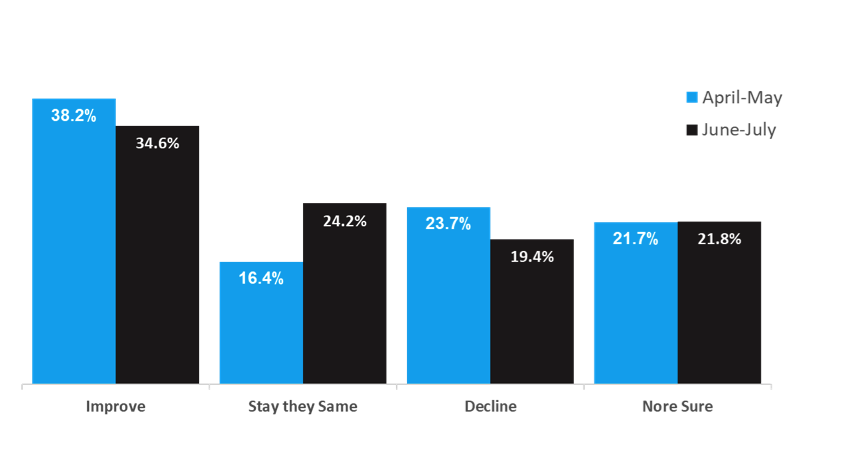

Confidence is moderating in the industry. Confidence levels indicate a tempering of both positive and negative expectations, as 34.6 percent expect business conditions to improve over the next month (down from 38.2 percent), 24.2 percent expect conditions to stay the same (up from 16.4 percent), and 19.4 percent expect conditions to decline (down from 23.7 percent).

Figure 2: Business Expectations Over the Next Month

n=211

A Path Towards Economic Recovery

Over the last month, we have seen the economy begin its reopening process. With the nature of the virus, different geographies and industries have opened at different paces. As retailers begin to open, some promotional products businesses will see a quick return to their usual business. Others who operate mainly in the event space will lag behind, as this area will be among the last to recover. In the meantime, demand for health care-related products will continue, so it is integral to be versatile to help your business stay afloat.

In terms of general U.S. economic health, things are beginning to trend upward from the lowest points. Consumer spending, the anchor of the U.S. economy, jumped a record 17.7 percent in May due to pent up demand. Key employment metrics improved as initial jobless claims numbers have tapered off significantly and the May unemployment rate of 13.3 percent was much lower than expected.

Of course, this good news must be taken cautiously. A rise in cases in some places has resulted in pauses of the reopening process as well as re-closures. Though the death count from the virus is slowing, decision makers are still being careful to ensure the safety of their citizens. It is integral to keep an eye on cases in your area and adhere to health and safety recommendations so that business can return as quickly as possible.

Download the second full report here.

Participate in the COVID-19 Promotional Products Business Indicators Research

In today’s unprecedented business environment, making decisions based on facts has never been more important. In the weeks and months ahead, reliable industry business indicators will be essential for monitoring what’s happening in all industry segments. The COVID-19 Promotional Products Business Indicators Research is an essential resource for monitoring industry conditions and the NAPCO Research and Promo Marketing teams invite you to join our business panel and contribute to the research on an ongoing basis. Companies that join the panel will receive an exclusive version of the report that includes additional data and analysis. To join the COVID-19 research panel, please click here.

About NAPCO Research

NAPCO Research develops research and economic models that solve customer business problems. Market research is valuable for making strategic business decisions, solving challenges, and pursuing opportunities, and the NAPCO Media research team surveys, analyzes, and monitors critical trends related to marketing, printing, packaging, non-profit organizations, promotional products, and retailing. To learn more about how the team can leverage its research and industry subject matter experts to support your organizations needs contact NAPCO’s Vice President of Research, Nathan Safran, at [email protected].